Craft distiller's (Class B distiller license) may now self-distribute up to 5,000 gallons of distilled spirits produced by or exclusively licensed by the distillery annually to any retail licensee. See below for reporting requirements.

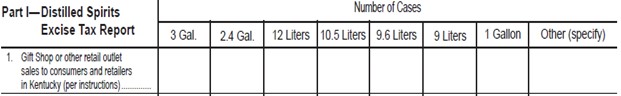

Part I—Distilled Spirits Excise Tax Report on “Monthly Report of Distillers, Rectifiers or Bottlers" (Form 73A525) - Continue to complete and submit as previously required. Beginning 7/15/2024, Craft Distillers shall include self-distributed distilled spirit quantities on line 1 (see below).

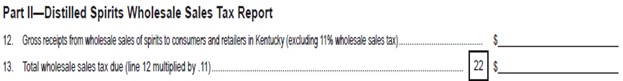

Part II—Distilled Spirits Wholesale Sales Tax Report on form 73A525 – Continue to report as previously required. Beginning 7/15/2024, gross receipts (excluding 11% wholesale sales tax) from direct sales made to retailers shall be reported on line 12 with gross receipts from sales made to consumers (see below).

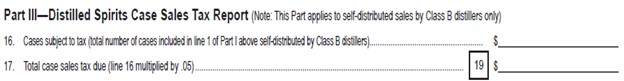

Part III – Distilled Spirits Case Sales Tax Report on form 73A525 – Craft distiller's (Class B distiller license) report total number of cases included on line 1 of Part I attributed to self-distributed distilled spirits sold to retailers in Kentucky (see below).

![]()